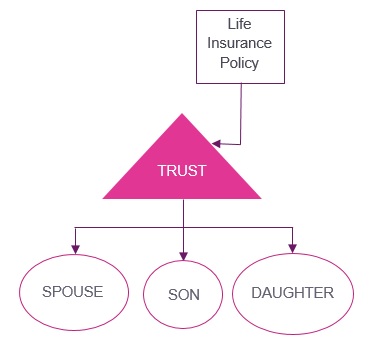

A life insurance trust is a trust that owns the life insurance policy you have purchased and collects the death proceeds when the insured passes away.

The trustee then distributes the death benefits to the trust beneficiaries according to the terms included in the trust document.

SETTING UP A LIFE INSURANCE TRUST FOR YOUR FAMILY

This ensures your family receives your insurance proceeds in an orderly manner over time.

WHY SET UP AN INSURANCE TRUST FOR YOUR FAMILY?

If you’ve bought life insurance to cover your family’s expenses in the event of your death, you may also want to set up a trust to hold the money for them.

Trusts aren’t just for the rich; they are important tools for any family.

WHAT DOES A TRUST DO?

A trust holds money for beneficiaries such as your children and parents. You determine how the money should be managed and used, and you appoint a trustee to oversee the process.

When you are buying life insurance, instead of naming your children directly as beneficiaries you can name a trustee. The trustee can then manage the money for your children according to the rules you set for the trust.

For example, your life insurance trust can:

- Take care of your funeral expenses and immediate debts;

- Provide security for your family over a period of time; and

- Control how the proceeds are distributed, such as a specified amount of living expenses every month

WHY AN INSURANCE TRUST IS NECESSARY FOR YOUR FAMILY?

Passing on a lump sum might work if you have a small policy such as $50,000. However, if your insurance pays out $500,000 or more, would you want your 18 or 21-year-old to get a huge windfall with no strings attached?

Even if your children are responsible, they may not have the experience to manage the money. That inexperience could leave them financially vulnerable.

With a trust, you can arrange for it to pay for your children’s upkeep and university education. The remaining money could then be distributed in portions to your children at specified times, such as on their 30th and 35th birthdays.

CASE STUDY

A 45-year mother bought a $1 million insurance policy to benefit her son, aged 12. She was going to make an insurance nomination to name her son as beneficiary.

Her financial adviser cautioned her that should she meet an early death, the insurance proceeds would be distributed to her son at age 18. This would make him an instant millionaire at a very young age.

The financial adviser introduced the lady to one of our trust officers and she set up an insurance trust. Now, if she were to pass away unexpectedly while her son is still young, the trust can pay for his upkeep over the years, his tuition and medical expenses until her son reaches 30 years of age or whatever age she chooses.