Used by wealthy families, individuals and non-profit organisations for a variety of purposes, including:

- Wealth creation and accumulation

- Succession planning

- Asset protection

- Enhanced confidentiality

- Asset consolidation and management

- Pooled family investment planning

- Anti-forced heirship planning

SIMILARITIES BETWEEN LABUAN FOUNDATION AND LABUAN TRUST

- Assets may be transferred / donated to both structures

- May be revocable

- May be created during the founder / settlor lifetime or on death

- May be unlimited in duration

- May appoint Protector or Enforcer

- Pooled family investment planning

- No capital requirements

- Can be established for any lawful purpose

DIFFERENCES BETWEEN LABUAN FOUNDATION AND LABUAN TRUST

TRUSTS | FOUNDATIONS |

Common law origins | Civil law origins |

Not a legal entity with separate legal existence | Separate legal entity |

Assets, upon being vested in the trust, are legally owned by trustee

| Assets are legally owned by the foundation. Upon registration of the foundation, the property endowed no longer belong to the founder, but belong to the foundation |

Relationship amongst parties is fiduciary | Relationship amongst parties is contractual |

• The person(s) who establishes the trust is known as the settlor • The persons who benefit from the trust are known as beneficiaries | • The person(s) who creates the endowment is known as the founder • The persons who benefit from the endowment are known as the beneficiaries |

No requirement to register trust | Registration of foundation is mandatory |

Trust deed is the document that establishes

| Charter is the main constituent document of a foundation. A foundation may also have articles with detailed rules governing its administration matters |

The appointed trustee is the person responsible to hold the trust assets and administer the trust

| An appointed body called the Council / Officer is entrusted to carry on the business and affairs of the foundation and pursue its objects. Officers and Council are required to act in accordance with the terms of the charter and articles |

Settlor may have certain reserved powers after establishing the trust and vesting the legal title in the trust assets to the trustee | The founder does not retain or acquire any ownership rights in relation to the foundation’s property. Beneficiaries or the persons in whose benefit the foundation was created may include the |

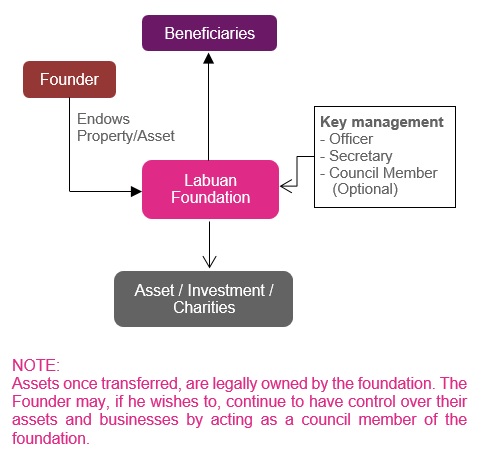

KEY PARTIES – LABUAN FOUNDATION

- Founder – Establish the foundation. May be either natural person or corporate and subscriber to the Charter

- Beneficiaries – Persons who have vested interest in assets of the foundation

- Officer – Administers the Foundation to achieve its purpose

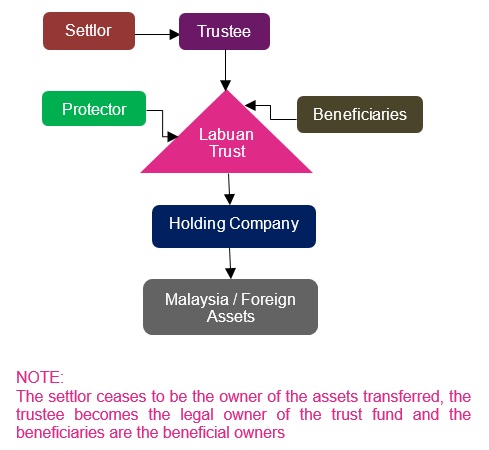

KEY PARTIES – LABUAN TRUST

- Settlor – Creates the trust by transfer assets into a trust. Settlor may be an individual person or a corporate entity

- Trustee – Holds the trust funds and is responsible for its administration for benefit of the beneficiaries

- Trust Deed – Central governing document and sets out trustee’s powers (among other things). Settlor is able to tailor the terms of the trust to satisfy their requirements

- Protector/Enforcer – May be appointed by settlor, who acts like a “watchdog” over the trustee for the benefit of the beneficiaries

- Beneficiaries – Persons legally entitled to enforce and benefit from the trust. Can be individual or reference to a class, charities, minors, corporations etc.

WHY THE NEED FOR SUCCESSION PLANNING

- Avoid probate formalities - Distribute assets to heirs efficiently without or minimising the cost, delay and publicity of probate court

- May protect your assets from creditors or other claimants if set up properly

- Control how a beneficiary receives assets

- Passing down of family wealth and values

- Family expansion and multiple families

- Give to charity

- Cross-border assets and beneficiaries

- Tax planning and mitigation in some jurisdictions

LACK OF PLANNING – CONSEQUENCES

- High legal costs and long probate

- Inaccessibility of assets due to legal process

- Family dispute and breakdown

- Family business breakdown

- Negative publicity

- Tax exposure in certain jurisdictions