The Malaysian Government has implemented the requirement for e-invoice, a digital representation of a transaction between a supplier and a buyer for goods and services rendered, which is applicable to all taxpayers undertaking commercial activities in Malaysia, including Labuan.

E-invoicing enables near real-time validation and storage of transactions, and the scope of e-invoicing encompasses Business-to-Business (B2B), Business-to-Consumer (B2C) and Business-to-Government (B2G) transactions.

About e-invoice

An e-invoice is a digital proof of a transaction between a supplier and a buyer. E-invoice replaces paper or electronic billing documents such as invoices, credit notes, debit notes and refund notes.

An e-invoice contains almost similar information as a traditional invoice, which includes but not limited to details of supplier and buyer, item description, quantity, price excluding tax, tax and total amount.

Implementation timeline

E-invoice will be implemented in phases to ensure smooth adaption and compliance.

Applicability

E-invoice applies to all taxpayers undertaking commercial activities in Malaysia. E-invoice is not limited to only transactions within Malaysia but also applicable for cross-border transactions.

Certain persons and types of income and expense, are exempted from e-invoice implementation.

Systems

There are two (2) options for issuance of e-invoice:

a. via MyInvois Portal

- A portal hosted by IRBM

- Accessible to all taxpayers at no cost

- Offering a comprehensive end-to-end e-invoicing compliance

b. Application Programming Interface (API)

- An in-house solution integrator

- A set of programming code enables direct data transmission between the taxpayers’ internal ERP or billing system to MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

Type of e-invoice documents

- Invoice - A commercial document that itemises and records a transaction between a Supplier and Buyer, including issuance of self-billed e-Invoice to document an expense.

- Credit note – A document issued by suppliers to correct errors, apply discounts, or account for returns in a previously issued e-Invoice with the purpose of reducing the value of the original e-Invoice. This is used in situations where the reduction of the original e-Invoice does not involve return of monies to the Buyer.

- Debit note – A document issued to indicate additional charges on a previously issued e-Invoice.

- Refund Note - A document issued by a supplier to confirm the refund of the buyer's payment. This is used in situations where there is a return of monies to the Buyer.

*A supplier / seller needs to issue e-Invoices for its sales to local buyers (domestic sales) as well as foreign buyers (international sales).

** A Malaysian Company (including a Labuan Entity) is required to issue self-billed invoices if it acquires any goods from foreign suppliers or enjoys any services rendered by foreign service providers.

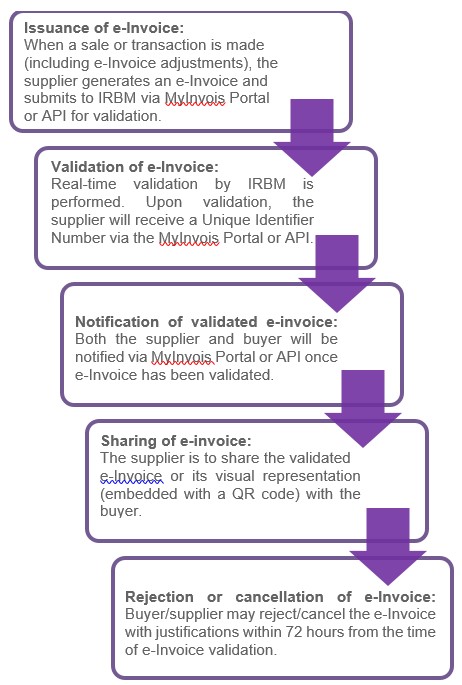

Workflow

An overview of the relevant steps are summarised below:

- Both supplier and buyer have the option to request and retrieve e-Invoice data via MyInvois Portal.

Penalty for failure to comply with the e-invoicing regime

Failure to issue e-Invoice is an offence under Section 120(1)(d) of the Income Tax Act 1967 and will result in a fine of not less than RM200 and not more than RM20,000 or imprisonment not exceeding 6 months or both, for each non-compliance

Tax incentives to taxpayers

The Malaysian government has announced the following tax incentives or grants in relation to implementation of e-Invoice during Budget 2024.

Tax deduction of up to RM50,000 for each year of assessment given on environmental, social and governance related expenditure, including consultation fee for the implementation of e-Invoice incurred by Micro, Small and Medium Enterprises (MSME), effective from year of assessment 2024 to year of assessment 2027.

The information in this document is not advice of any kind but general information only and should not be relied on as legal advice. Kensington Trust Group recommends seeking professional advice on legal or tax issues affecting you before relying on it. While Kensington Trust Group tries to ensure that the content of this document is accurate, adequate or complete, it does not represent or warrant, express or implied, its accuracy, correctness, completeness or use of any of the information. Kensington Trust Group does not assume legal liability for any loss suffered as a result of or in relation to the use of this document. To the extent permitted by law, Kensington Trust Group excludes any liability for negligence, for any loss, including indirect or consequential damages arising from or in relation to the use of this document.