Private Trust Companies (PTCs) are established with the sole purpose of acting as corporate trustee to a trust or a number of trusts, created by a settlor or individuals connected to the settlor described in the trust instrument creating the private trust.

MEANING OF PRIVATE TRUST

“Private trust” here means a trust where each beneficiary of the trust is a connected person in relation to the settlor of the trust. A person is a connected person to the settlor in respect of the following relationships:-

- his spouse;

- his descendants and their spouses;

- his parents, including step-parents;

- his grandparents and his spouse’s grandparents;

- his parents-in-law, including step-parents-in-law;

- his brother, step-brother, sister, step-sister and their spouses;

- his spouse’s brother, step-brother, sister, step-sister and their spouses and children;

- his parent’s brother, step-brother, sister, step-sister and their spouses;

- children of the brother, step-brother, sister or stepsister of his parents, both present and future, including step-children and their spouses; and

- children of his brother, step-brother, sister or stepsister, both present and future, including stepchildren and their spouses.

PTCs are commonly used by wealthy and high net worth (HNW) families in their wealth structuring, for a number of reasons explained below.

SETTING UP SINGAPORE PTC

There is no requirement for the Singapore PTC to be registered with the Monetary Authority of Singapore (MAS) but PTCs must engage a licensed trust company to carry out Anti-Money Laundering services.

BENEFITS OF USING SINGAPORE PTC

- Confidentiality- certain confidentiality can be maintained by using a PTC, rather than an independent professional trustee.

- Control and influence - The board of the PTC may consist of the settlor, members of his family and trusted advisors (if the settlor wishes to). The settlor and his family members have direct involvement in the decision making processes.

- Management succession planning – A vehicle to familiarise the family members with the wealth and business interests owned by the trust and instruct them in the management of these assets.

- Continuity – The administrator / agent may change but the PTC will remain as trustee providing continuing of asset ownership.

- Diversified underlying assets – Independent professional trustees may be reluctant or slow in giving approval to hold certain assets or entering into major transactions. PTC allows greater choice as to what investments may be made with the trust fund based on varied knowledge of family members acting as Board members.

- Ownership succession– The PTC may be owned by the settlor or family member(s). However, it is common to use a non-charitable purpose trust, the sole purpose of which is to own the shares of the PTC with no requirement to appoint beneficiaries.

OPERATIONAL REQUIREMENTS OF REGISTERED SINGAPORE PTCs

- Observe the statutory requirements of Singapore PTCs under the companies;

- Proper arrangements in place to account for and keep all assets and other valuables that it has received in its capacity as trustee duly separated from the PTC’s own assets and liabilities;

- Comply with guidelines, directive and reporting requirements issued by MAS;

- Singapore PTCs may appoint an external auditor and conduct an annual audit. Nevertheless, it must ensure that all its accounting and other records are properly kept and managed;

- A PTC carrying on a Singapore business activity is required to file relevant tax returns with the Inland Revenue Authority of Singapore.

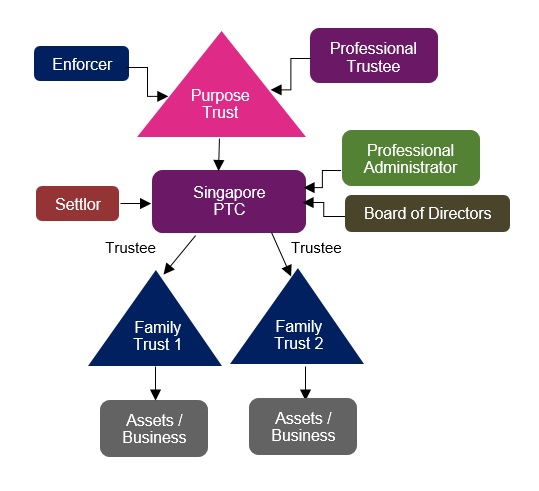

TYPICAL DIAGRAM OF SINGAPORE PTC

- Settlor – Creates the trust by transfer assets into the PTC. Settlor may be an individual person or a corporate entity

- Professional Administrator - Licensed trust company in Singapore

- Board of Directors - May comprised of settlor, family members, advisors

- Trustee – Act as trustee of private trust

- Enforcer of Purpose Trust – Ensure that the Professional Trustee acts in accordance with the terms of the purpose trust. This person must not be the same as the Professional Trustee

- Professional Trustee - Holds the shares of the PTC to overcome succession issues upon the demise of the settlor.

KEY REQUIREMENTS OF SINGAPORE PTC

- The PTC’s sole purpose is to provide trust services to the family (connected persons) and prohibited from soliciting trust business from, or provide trust business services to, the public.

- The PTC is exempted under the Trust Companies Act (“TCA”) from holding a trust business licence.

- The PTC is required, under regulation 4(2) of the Trust Companies (Exemption) Regulations, to engage a licensed trust company to carry out trust administration services for the purposes of conducting the necessary checks to comply with any written direction issued by Monetary Authority of Singapore (“MAS”) on the prevention of money laundering or countering the financing of terrorism.

- A PTC may only provide trust services to the private trust. The types of services to be provided by a Singapore PTC may include the following:

- Provide trustee services including review of the trust instrument(s) and the type of assets funding the trust(s), trust management and accounting services;

- Carry out activities such as being an agent, executor or administrator or other activities pursuant to the objectives of the PTC.

DUTIES OF PROFESSIONAL ADMINISTRATOR

The licensed trust company acting as administrator for the PTC not only provides professional guidance, it also assists trustee in, but not limited to, the following areas of trust administration:

- keeping of accounting records and the preparation of trust accounts;

- the administration of trust assets;

- preparation of documents to assist with addition, transfer and disposal of trust assets;

- guidance and preparation of documents in relation to addition or removal of beneficiaries;

- guidance and preparation of documents in relation to the distribution of trust assets;

- preparation of documents in relation to the payment of expenses or remuneration;

- assisting in opening bank accounts

- liaising with tax and legal advisors, including matters relating to FATCA and CRS reporting

The licensed trust company will conduct periodic anti-money laundering (“AML”) audits on the activities of the PTC and provide recommendations for best practices on the prevention of money laundering or countering the financing of terrorism in accordance to MAS guidelines.