In conventional trusts, the trustee generally have a high level of control over the trust asset and the settlor has no rights left in respect of the trust asset. However, many settlors are not comfortable with the idea of handing over complete or exclusive control over their asset to another party.

Arising from this, a number of jurisdictions have formalised what are often referred to as reserved powers trust. Specific legislations had been enacted to ensure that settlor’s reserved powers arrangements can be put in place without prejudicing the validity of the trusts themselves.

INTRODUCTION

When a settlor creates a Reserved Powers Trust, he can reserve to himself, or grant to a third party (eg. a protector), certain rights and powers. Most commonly, settlors will wish to reserve:

- powers to appoint / remove investment managers, brokers

- powers of investment

Amongst jurisdictions which allow exercise of reserved powers without invalidating a trust are Jersey, Guernsey, Singapore, Labuan and Cayman Islands.

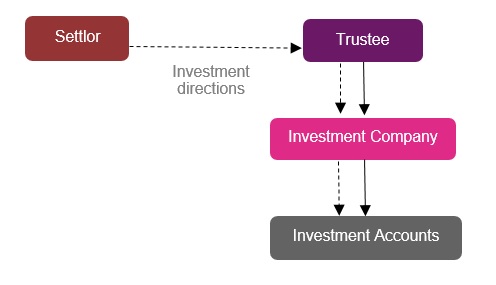

Example 1: Power to give investment directions

Included in the trust deed is an express power for the Settlor to give investment directions to the Trustee (usually only for as long as the Settlor is not under any incapacity).

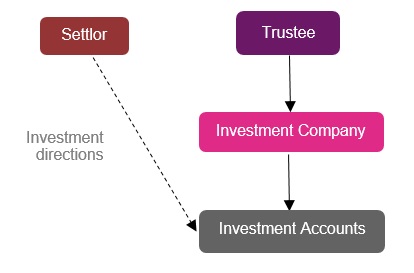

Example 2: Power to effect investments

Under this approach, the trust deed includes a provision enabling the Settlor to direct the Trustee to issue to him a limited trading power of attorney, enabling him to effect investments.

As with the first example, the Trustee’s own powers of investment are "suspended".

This may be a better arrangement compared to the first example as the Settlor may deal directly with the broker in effecting investment transactions, and without being deemed an agent of the Trustee. The substantive sham risk is likely to be reduced because the trust deed more closely reflects how the trust is to be administered in practice.

CONCLUSION

There are good reasons why settlors who are more knowledgeable and sophisticated, and demand a more active involvement in investment decisions would want to reserve powers over the trust. Trustees are increasingly recognising the potential advantages of structuring trusts as reserved power trusts rather than as fully discretionary trusts, in appropriate cases.

However, the degree of settlor’s control has to be balanced against the fundamental concept of trust.