Unlike traditional trusts, a purpose trust is a type of trust which has no beneficiaries. The trust can be established and exist for specified purpose(s). Trusts for charitable purposes are also technically purpose trusts, but they are usually referred to simply as charitable trusts. People referring to purpose trusts are usually taken to be referring to non-charitable purpose trusts. In certain jurisdictions, statute allows for the creation of purpose trusts for non-charitable purposes including for private benefits. In this document, purpose trust refers to trust created for non-charitable purposes.

KEY FEATURES OF A PURPOSE TRUST

- No requirement to appoint beneficiaries.

- Objects for which the trust has been established must be clear in the purpose trust instrument.

- Valid purpose must be stated in the terms of the trust. The purpose must be consistent with public policy and must be reasonable and attainable.

- Must appoint trustee(s).

- Required to have an enforcer whose duty is to enforce the trust in relation to its stated purposes.

- May have a trust protector if the settlor wishes to.

- Generally, a purpose trust can continue in existence for an unlimited period unless the terms of the trust provide otherwise. However, statute of certain jurisdictions may restrict duration of purpose trust.

BENEFITS OF PURPOSE TRUSTS

- Useful solution where assets need to be held and for specific purposes without giving any person or class of persons an interest in those assets.

- Flexible structure which can be used for a whole range of purposes.

- Comfort to the settlor that the Trustee is responsible to ensuring that his original wishes and purposes for setting up the trust are adhered to.

COMMON USES OF PURPOSE TRUSTS

- In commercial transactions and refinancing arrangements that requires holding of shares in a special purpose vehicle used in off-balance sheet transactions, commonly known as “orphan” structure.

- To hold voting shares in family companies. Participating shares could be issued to family members, allowing them to benefit from success of the business, without the ability to sell it or wind it up.

- To hold shares in a Private Trust Company (PTC) which acts as trustee for trust(s) for the same family.

- For social benefit projects, both public and private, which are not regarded as charitable in law.

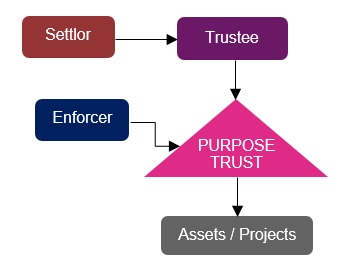

TYPICAL DIAGRAM OF A PURPOSE TRUST

- Settlor – Creates the trust by transfer assets into a trust. Settlor may be an individual person or a corporate entity

- Trustee – Holds the trust funds and responsible for its administration in accordance with the purpose of the trust

- Enforcer – Ensure that the Trustee utilize the trust funds for the specified purposes and the Trustee acts in accordance with the terms of the trust. This person must not be the same as the Trustee.

- Assets may include shares in private companies. The underlying companies could be under the management and control of the client without involving the Trustee. However, if the Settlor wishes to, the Trustee can manage and control the underlying companies.