The concept of trust was first established in English law in the 13th century. A trust is created when assets or properties are given or entrusted to someone to hold on behalf and for the benefit of someone else. The person who creates the trust (the “Settlor”) will generally transfer assets or properties to a trustee who holds them in what is known as a trust fund. The trustee holds the trust fund for the exclusive benefit of a class of person (the “beneficiary”). The trust deed is the central governing document in any trust arrangement.

The essential elements of a trust are that the Settlor ceases to be owner of the assets or properties transferred into the trust; the trustee becomes the legal owner of the trust fund and the beneficiary as beneficial owner.

LABUAN TRUSTS

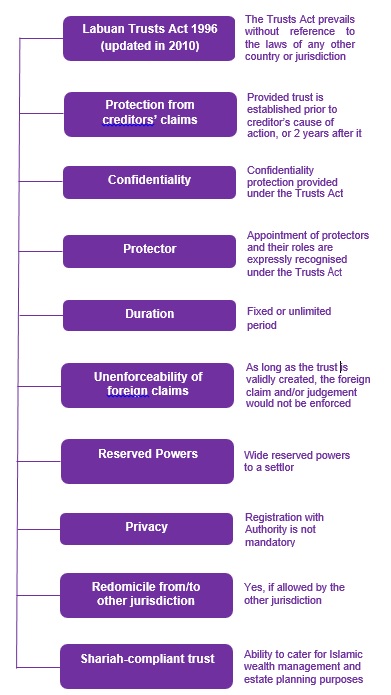

Labuan trusts are created under the Labuan Trusts Act 1996 (“LTA”) (updated in 2010) and the Labuan Islamic trusts established under Section 105 of the Labuan Islamic Financial Services and Securities Act 2010 (LIFSSA) in the Labuan International Business and Financial Centre (“IBFC”). Guidelines were issued by the Labuan Financial Services Authority (“FSA”) to provide further guidance on the creation of Labuan trust and Islamic trust (the “Guidelines”).

A Labuan trust can be created by a will or other instruments in writing, including through a unilateral declaration.

The trust would usually be irrevocable, although there may be some circumstances where the settlor may require the comfort of knowing he has the power to revoke the trust. However, this preservation of power can negate some of the intended benefits of setting up the trust in the first place.

It is not mandatory for a Labuan trust to be registered with Labuan FSA. However, if the Settlor opt to register the Labuan trust with Labuan FSA, any subsequent changes made by the Trustee must be submitted to Labuan FSA.

TYPES OF TRUSTS AVAILABLE IN LABUAN IBFC

- Purpose Trust

- Charitable Trust

- Labuan Special Trust

- Spendthrift or Protective Trusts

- Reserved Powers Trusts

PURPOSES OF LABUAN TRUSTS

Individuals, families, corporations and non-profit organisations will find trusts a versatile solution for their different objectives.

WHO CAN SET UP A LABUAN TRUST?

Any person, individuals and corporations who are resident and non-residents of Malaysia.

PROPERTY / ASSET OF A LABUAN TRUST

- Assets of every kind whether corporeal or incorporeal, movable or immovable, tangible or intangible, however acquired; and

- Legal documents or instruments in any form, including electronic or digital, evidencing title to or interest in such property.

For Malaysian property, prior approval of Labuan FSA is required. The qualifying criteria for approval shall include but not limited to the following:

- Obtain all necessary approvals from the relevant authorities in relation to the vesting of properties to the trust;

- Properties to be vested shall be unencumbered unless necessary consents have been obtained; and

- Properties to be vested shall be obtained through lawful means.

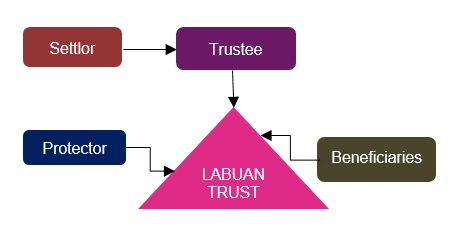

PARTIES TO A LABUAN TRUST

Settlor – Creates the trust by transfer assets or properties into a trust. Settlor may be an individual person or a corporate entity

Trustee – Holds the trust funds and responsible for its administration for benefit of the beneficiaries. Minimum one (1) trustee from Labuan trust company or Labuan managed trust company

Beneficiary – Person legally entitled to enforce and benefit from the trust. Can include individual or reference to a class, charities, minors, corporations etc.

Protector – May be appointed by settlor, who acts like a “watchdog” over the trustee for the benefit of the beneficiary. The settlor or beneficiary may also be a protector

DURATION OF A LABUAN TRUST

The Labuan trust may exist for a fixed period or in perpetuity as specified by the terms of the trust. Additional terms may be specified to alter, by lengthening or shortening the trust during its life-time.

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan,

- excluding any activity which is an offence under any written law.

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2018 that took effect on 1st January 2019:

- Labuan trading activity has been restricted to license business activities only.

- Labuan non-trading activity has been restricted to holding entity, namely Pure Equity Holding and Non-Pure Equity Holding.

“Entity” in LBATA includes Labuan trust established and registered under the LTA.

SUBSTANCE REQUIREMENT UNDER LBATA (WITH EFFECT FROM 1ST JANUARY 2019)

Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

Section 2B (1A) of LBATA further provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

As the business activities of this type of entity is generally involved in either Pure Equity Holding or Non Pure Equity Holding, the Substance Requirements are as follows:

Pure Equity Holding

To comply with management and control requirement in Labuan and incur minimum annual operating expenditure of RM20,000 per annum in Labuan. Please note that the trustee is based in Labuan, and trust administration is also carried out in Labuan.

Non Pure Equity Holding

To comply with minimum of one (1) full time employee in Labuan and minimum annual operating expenditure of RM20,000 per annum in Labuan.

DEALINGS WITH RESIDENTS

Labuan entities are allowed to conduct transactions with residents of Malaysia in Ringgit Malaysia. “Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to s.43 of the Malaysian Exchange Control Act 1953.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

> Interest expense | 75% deductible |

> Lease rental | 75% deductible |

> General reinsurance premiums | 100% deductible |

> Other type of payments | 3% deductible |

BENEFITS OF LABUAN TRUSTS