In 2010, amendments were made which allowed for the introduction of a new type of trust called the Labuan Special Trust (“LST”), which to a large extend modelled itself against the Virgin Islands Special Trust Act (VISTA) in the British Virgin Islands. A significant advantage in a LST is that it can be used to hold and retain shares indefinitely in a company, which in turn may be used to own assets such as cash, real estate, art securities, businesses, insurance policies etc. In this context, “company” refers to either a Labuan company or a partnership interest in a Labuan limited liability partnership.

Contrary to conventional approach, it allows management of the company to be carried out by its directors without any power of intervention being exercised by the trustee (other than those prescribed under the legislation). Therefore, a trustee appointed under a LST shall have no fiduciary responsibility or duty of care in respect of the property of, or the conduct of the affairs of, the company, except when acting, or required to act, on an intervention call ie. made by an interested person whom may have a complaint concerning the conduct of the company’s affairs.

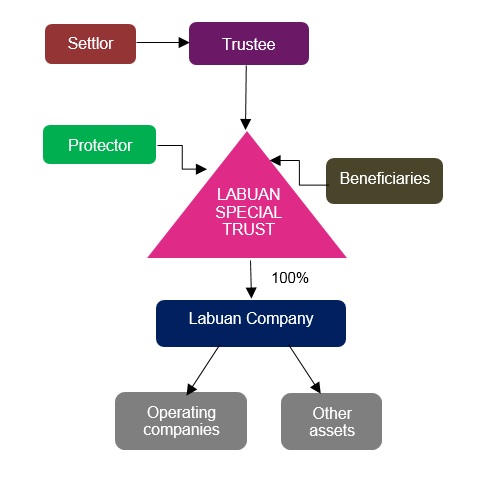

TYPICAL DIAGRAM OF A LABUAN SPECIAL TRUST

KEY FEATURES OF LABUAN SPECIAL TRUST

Settlor

Person setting up the trust, may be individual or corporate, Malaysian resident or non-resident.

Trustee

- One trustee must always be a licensed Labuan Trust Company.

- More trustee(s) can be appointed, if required.

- However, a trustee shall not be a director of the company where shares are held by the said trustee.

- Holds the trust funds and responsible for its administration for benefit of the beneficiaries.

Protector

- May be appointed by settlor, who acts like a “watchdog” over the trustee for the benefit of the beneficiary.

- The settlor or beneficiary may also be a protector.

- These parties can also act on advisory / consultancy basis

Beneficiary

Person legally entitled to enforce and benefit from the trust. Can include individual or reference to a class, charities, minors, corporations etc.

Labuan Company

- Company owned by the Trustee.

- Trustee will not get involved in the day-to-day running of this company and its underlying companies.

- Allows for the separation of the custodianship of the assets from the investment of the assets.

Assets of the Trust

- May encompass Malaysian assets, however consent from the Labuan Financial Services Authority (“Labuan FSA”) needs to be obtained if Malaysian assets are to be injected into Trust.

- No consent of Labuan FSA is required for injection of non-Malaysian assets.

Duration of Trust

No perpetuity period

Letter of Wishes

Settlor can also use Letter of Wishes to provide guidance to the Trustee in matters affecting trust (particularly distribution) for situations that may arise post his demise. Though not legally binding, Trustee normally rely on this letter.

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan,

- excluding any activity which is an offence under any written law.

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2018 that took effect on 1st January 2019:

- Labuan trading activity has been restricted to license business activities only.

- Labuan non-trading activity has been restricted to holding company, namely Pure Equity Holding and Non-Pure Equity Holding.

“Entity” in LBATA includes Labuan trust as defined in the Labuan Trusts Act 1996.

SUBSTANCE REQUIREMENT UNDER LBATA (with effect from 1st January 2019)

Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

Section 2B (1A) of LBATA further provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

As the business activities of these types of entities (Labuan Trust and Labuan Company) are generally involved in either Pure Equity Holding or Non Pure Equity Holding, the Substance Requirements are as follows:

Pure Equity Holding

To comply with management and control requirement in Labuan, the entity is to hold at least a minimum of one Council/Officer meeting in Labuan for each calendar year and incur minimum annual operating expenditure of RM20,000 per annum in Labuan.

Non Pure Equity Holding

To comply with minimum of one (1) full time employee in Labuan and minimum annual operating expenditure of RM20,000 per annum in Labuan.

DEALINGS WITH RESIDENT

Labuan entities are allowed to conduct transactions with residents of Malaysia in Ringgit Malaysia. “Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to s.43 of the Malaysian Exchange Control Act 1953.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

> Interest expense | 75% deductible |

> Lease rental | 75% deductible |

> General reinsurance premiums | 100% deductible |

> Other type of payments | 3% deductible |

ADVANTAGES

- Trustee does not interfere in the management or conduct of any business of the underlying companies.

- Trustee shall not instigate or support any action by the company against any of its directors for breach of duty to the company or procure the appointment or removal of any of the directors.

- Provisions for unenforceable claims; a two-year claw-back period and requirements for legal procedures should a creditor attempt to prove a trust is fraudulent.

- Meets the contemporary needs of High Net Worth Individuals or families who recognise that members of the next, younger and better educated generation may wish to attempt more sophisticated investment options; yet by separating the roles indicated above, the founders of wealth (the older generation) can still keep the original legacy intact. This feature is one of the most sought after in Trust Law.

- Existence of the trust in perpetuity.

- Option not to register the trust to protect privacy.

- No foreign exchange controls in Labuan.

- Double Tax Agreements between Malaysia and over 70 countries.

- No capital gain tax, inheritance tax.

- Withholding tax exemption on payments made to non-residents.