The Labuan Share Trust is a specially structured trust established in accordance with Part IV A (Labuan Special Trust) of the Labuan Trusts Act 1996, designed specifically to hold shares of a Labuan company or partnership interests in a Labuan limited liability partnership. A very simple life interest trust, practical and low-cost solution to manage succession planning. It allows management of the underlying company(ies) to be carried out by its directors without any power of intervention being exercised by the trustee during his/her lifetime. On death of the Settlor, the trustee shall distribute the Shares to the beneficiaries named in the trust instrument.

KEY FEATURES OF LABUAN SHARE TRUST

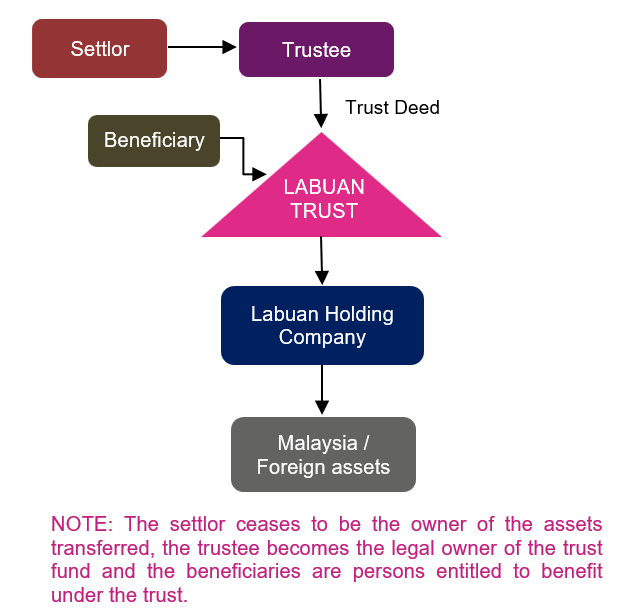

- Settlor – Creates the trust by transfer assets into a trust. Settlor may be an individual person or a corporate entity.

- Trustee – Holds the trust funds and is responsible for its administration for benefit of the named beneficiaries.

- Trust Deed – Central governing document and sets out trustee’s powers (among other things). Settlor is able to tailor the terms of the trust to satisfy their requirements.

- Beneficiaries – Persons legally entitled to enforce and benefit from the trust. Can be individual or reference to a class, charities, minors, corporations etc.

REQUIREMENTS

- The Labuan Share Trust is used for holding shares in Labuan company or partnership interest in a Labuan limited liability partnership.

- Designated shares must be transferred to the Trust without any charge, lien or encumbrance.

- A sole Settlor for each Share Trust structure.

- All beneficiaries must be aged 18 and above or have a legally appointed guardian.

- Trustee may only distribute shares to adult beneficiaries. If Settlor passes on before any beneficiaries reach the age of 18, Trustee will hold the minor’s shares until they reach the age of 18.

- Both Settlor and Trustee retain option to revoke the trust and the extent and exact scope for this will be elaborated in the trust deed.

BENEFITS OF LABUAN SHARE TRUST

- Enhanced confidentiality.

- Certainty of succession.

- There shall be no activities at the trust level during the lifetime of the trust – hence making it cost efficient and effective.

- Avoid probate formalities - Distribute assets to heirs efficiently with minimum cost, delay and publicity of legal proceedings.

- The Settlor or appointee remains director of the underlying companies during the Settlor’s lifetime and enjoys lifetime income and voting rights.

- Flexible - the Settlor may cancel and revoke the arrangement at any time. A new trust arrangement can be established reflecting the Settlor’s new wishes.