Private Trust Companies (PTCs) are established with the sole purpose of acting as corporate trustee to a trust or a number of trusts, created by a settlor or individuals connected to the settlor described in the trust instrument creating the private trust.

MEANING OF PRIVATE TRUST

“Private trust” here means a trust where each beneficiary of the trust is a connected person in relation to the settlor of the trust. A person is a connected person to the settlor in respect of the following relationships:-

- his spouse;

- his descendants and their spouses;

- his parents, including step-parents;

- his grandparents and his spouse’s grandparents;

- his parents-in-law, including step-parents-in-law;

- his brother, step-brother, sister, step-sister and their spouses;

- his spouse’s brother, step-brother, sister, step-sister and their spouses and children;

- his parent’s brother, step-brother, sister, step-sister and their spouses;

- children of the brother, step-brother, sister or stepsister of his parents, both present and future, including step-children and their spouses; and

- children of his brother, step-brother, sister or stepsister, both present and future, including stepchildren and their spouses.

PTCs are commonly used by wealthy and high net worth (HNW) families in their wealth structuring, for a number of reasons explained below.

APPLICATION FOR LABUAN PTC

Application for a PTC registration must be forwarded to the Director General of Labuan FSA.

Kensington Trust Labuan Limited is licensed appropriately to handle the application and to act as agent of Labuan PTC. Please discuss with Kensington Trust Labuan Limited on the requirements, procedures and estimated timeline for application of a PTC.

BENEFITS OF USING LABUAN PTC

- Confidentiality - can be maintained by using a PTC, rather than an independent professional trustee.

- Control and influence - The board of the PTC may consist of the settlor, members of his family and trusted advisors (if the settlor wishes to). The settlor and his family members have direct involvement in the decision making processes.

- Management succession planning – A vehicle to familiarise the family members with the wealth and business interests owned by the trust and instruct them in the management of these assets.

- Continuity – The administrator / agent may change but the PTC will remain as trustee providing continuing of asset ownership.

- Diversified underlying assets – Independent professional trustees may be reluctant or slow in giving approval to hold certain assets or entering into major transactions. PTC allows greater choice as to what investments may be made with the trust fund based on varied knowledge of family members acting as Board members.

- Cost – The ongoing costs may be less than the trustee fees charged by independent professional trustee, particularly if the trust assets are substantial.

- Ownership succession – The PTC may be owned by the settlor or family member(s). However, it is common to use a non-charitable purpose trust, the sole purpose of which is to own the shares of the PTC with no requirement to appoint beneficiaries.

LABUAN FSA FEES FOR PTC

Processing Fee (once-off)

USD350 each application

Annual Licence Fee

Licence fee of USD1,500 is payable to Labuan FSA upon the grant of registration for Labuan PTC and remains valid until 31 December of the year of approval.

Subsequent annual licence fee of USD1,500 is payable to Labuan FSA on or before 15 January of each calendar year.

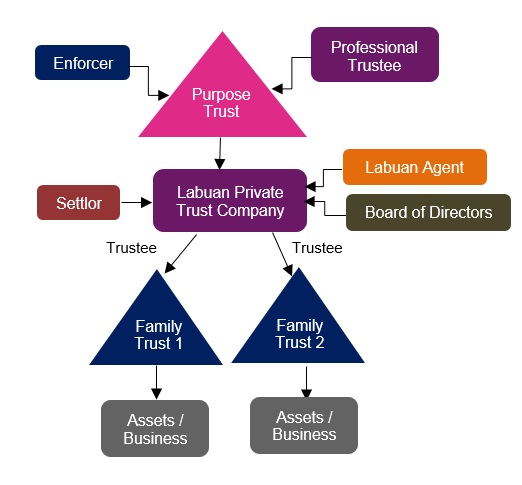

TYPICAL DIAGRAM OF LABUAN PTC

- Settlor – Creates the trust by transfer assets into the PTC. Settlor may be an individual person or a corporate entity

- Labuan Agent - Licensed trust company in Labuan

- Board of Directors - May comprised of settlor, family members, advisors

- Trustee – Act as trustee of private trust and provision of allowed Labuan PTC services

- Enforcer of Purpose Trust – Ensure that the Professional Trustee acts in accordance with the terms of the purpose trust. This person must not be the same as the Professional Trustee

- Professional Trustee - Holds the trust asset and responsible to ensure that the original purpose is adhere to in accordance with the purpose of the trust

KEY REQUIREMENTS OF LABUAN PTC

- Incorporated under Labuan Companies Act 1990 (LCA) as a Labuan company or a foreign Labuan company (“Labuan branch”).

- The PTC must maintain a registered office in Labuan.

- The PTC must appoint a licensed Labuan trust company as its agent.

- A PTC business may only provide the trust company services to the private trust. The types of services to be provided by a Labuan PTC may include the following:

> Provide trustee services including review of the trust instrument(s) and the type of assets funding the trust(s), trust management and accounting services;

> Perform secretarial duties of the private trust(s), such as lodgement of any documents and reports through the Labuan trust company (appointed Agent) as required under the Labuan Financial Services and Securities Act 2010 (LFSSA);

> Carry out activities such as being an agent, executor or administrator or other activities pursuant to the objectives of the PTC; and

> Provide other services as may be approved by Labuan FSA from time to time.

LABUAN IBFC TAX SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act, 1967 (ITA).

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan

- excluding any activity which is an offence under any written law

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2018 that took effect on 1st January 2019:

- Labuan trading activity has been restricted to license business activities only.

- Labuan non-trading activity has been restricted to holding company, namely Pure Equity Holding and Non-Pure Equity Holding.

Labuan companies carrying on both Labuan trading and non-trading activities will be deemed to be carrying on Labuan trading activities. Hence, it will have the same tax treatment as those undertaking Labuan trading activity mentioned above.

SUBSTANCE REQUIREMENT UNDER LBATA (with effect from 1st January 2019)

> Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall, for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

> Section 2B (1A) of LBATA provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

> To benefit under LBATA, a PTC will need to comply with the substance requirements of minimum number of three (3) full time employees in Labuan and minimum annual operating expenditure of RM120,000 in Labuan.

DEALINGS WITH RESIDENT

All Labuan entities are allowed to conduct transactions with Residents of Malaysia in Ringgit Malaysia subject to the filing of a notification to Labuan FSA within 10 days from the transaction effective date. “Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to s.43 of the Malaysian Exchange Control Act 1953.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

| > Interest expense | 75% deductible |

| > Lease rental | 75% deductible |

| > General reinsurance premiums | 100% deductible |

| > Other type of payments | 3% deductible |