Private Trust Companies (PTCs) are established solely for the purpose of acting as a corporate trustee for one or more trusts, created by a settlor or by individuals connected to the settlor, as specified in the trust instrument creating the private trust.

MEANING OF PRIVATE TRUST

“Private trust” refers to a trust in which every named beneficiary of the trust is a connected person related to the settlor of the trust. A person is considered a connected person to the settlor if they fall within any of the following relationships: -

- his spouse;

- his descendants and their spouses;

- his parents, including step-parents;

- his grandparents and his spouse’s grandparents;

- his parents-in-law, including step-parents-in-law;

- his brother, step-brother, sister, step-sister and their spouses;

- his spouse’s brother, step-brother, sister, step-sister and their spouses and children;

- his parent’s brother, step-brother, sister, step-sister and their spouses;

- children of the brother, step-brother, sister or stepsister of his parents, both present and future, including step-children and their spouses; and

- children of his brother, step-brother, sister or stepsister, both present and future, including stepchildren and their spouses.

PTCs are commonly used by wealthy and high net worth (HNW) families in their wealth structuring, mainly driven by the increased level of control and privacy

APPLICATION FOR LABUAN PTC

Applicant shall submit the application for registration of a PTC to the Labuan FSA for approval.

JTC Kensington is licensed to handle the application and to act as agent of a Labuan PTC.

BENEFITS OF USIN]G LABUAN PTC

- Confidentiality – Allows enhanced confidentiality with the use of a PTC, rather than an independent professional trustee.

- Control and influence - The board of Directors of the PTC may include the settlor, family members and trusted advisors (if the settlor wishes to). This allows the settlor and his family members to have direct involvement in the decision-making processes.

- Management succession planning – A vehicle to educate, involve and familiarise the family members with the management of family wealth and business interests owned by the trust.

- Continuity – While the trust administrator or agent may change over time, the PTC will remain as trustee, ensuring continuity in the asset ownership and oversighting.

- Diversified underlying assets – Independent professional trustees may be cautious or slow in approving certain investments or asset types. With the PTC, the family – via its board of Directors, can make informed and timely decision as to what investments to be made using the trust fund, leveraging on the knowledge of family members acting as members of the Board.

- Cost Efficiency – The PTC structure may offer a more cost-effective approach, as the recurring costs could be lower than the trustee fees charged by an independent professional trustee, particularly when the trust assets are substantial.

- Ownership succession – The PTC can be owned directly by the settlor or family member(s). However, for long-term continuity and neutrality, it is common to use a non-charitable purpose trust to own the shares of the PTC. This ensures the PTC to be operated independently, aligned with its intended purpose without needing to appoint beneficiaries.

LABUAN FSA FEES FOR PTC

Processing Fee (one-off)

USD500 each application

Annual Licence Fee

Licence fee of USD1,500 is payable to Labuan FSA upon the grant of registration for Labuan PTC and remains valid until 31 December of the year of approval.

Subsequent annual licence fee of USD1,500 is payable to Labuan FSA on or before 15 January of each calendar year.

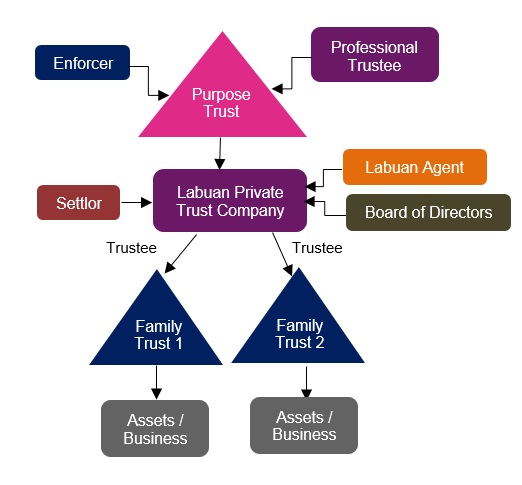

TYPICAL DIAGRAM OF LABUAN PTC

- Settlor – Creates the trust by transfer assets into the PTC. Settlor may be an individual person or a corporate entity.

- Labuan Agent - Licensed trust company in Labuan.

- Board of Directors - May comprised of settlor, family members, advisors.

- Trustee – Act as trustee of private trust and provision of allowed Labuan PTC services.

- Enforcer of Purpose Trust – Ensure that the Professional Trustee acts in accordance with the terms of the purpose trust. This person must not be the same as the Professional Trustee.

- Professional Trustee - Holds the trust asset and responsible to ensure that the original purpose is adhere to in accordance with the purpose of the trust.

KEY REQUIREMENTS OF LABUAN PTC

- The PTC shall be Incorporated under Labuan Companies Act 1990 (LCA) as a Labuan company or a foreign Labuan company (“Labuan branch”).

- The PTC must maintain a registered office in Labuan.

- The PTC must appoint a licensed Labuan trust company as its agent.

- A PTC business can only provide the trust company services to the private trust. The types of services to be provided by a Labuan PTC may include the following:

> Provide trustee services including review of the trust instrument(s) and the type of assets funding the trust(s), trust management and accounting services;

> Perform secretarial duties of the private trust(s), such as lodgement of any documents and reports through the Labuan trust company (appointed Agent) as required under the Labuan Financial Services and Securities Act 2010 (LFSSA);

> Carry out activities such as being an agent, executor or administrator or other activities pursuant to the objectives of the PTC; and

> Provide other services as may be approved by Labuan FSA from time to time.

LABUAN IBFC TAX SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on by a Labuan entity in, from or through Labuan.

Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act, 1967 (ITA).

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan

- excluding any activity which is an offence under any written law

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021:

- Labuan trading activity has been restricted to licensed business activities and selected type of trading activities only. Please refer to the above Regulations 2021.

- Labuan non-trading activity has been restricted to holding activities, namely Pure Equity Holding and Non-Pure Equity Holding.

Labuan companies carrying on both Labuan trading and non-trading activities will be deemed to be carrying on Labuan trading activities. Hence, it will have the same tax treatment as those undertaking Labuan trading activity mentioned above.

SUBSTANCE REQUIREMENT UNDER LBATA

> Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall, for the purpose of the Labuan business activity, have :-

- an adequate number of fit and proper full-time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

> Section 2B (1A) of LBATA provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

> To benefit under LBATA, a PTC will need to comply with the substance requirements of minimum number of three (3) fit and proper full-time employees in Labuan and minimum annual operating expenditure of RM120,000 in Labuan.

DEALINGS WITH RESIDENT

All Labuan entities may conduct transactions with Residents of Malaysia in Ringgit Malaysia except for:

- Issuing or offering to any Residents of Malaysia for subscription or purchase; or

- Invite any resident to subscribe or purchase

any interest pursuant to the relevant provisions of the Interest Schemes Act 2016 where such issue or offer or invitation is made in Malaysia, other than Labuan, unless the provisions of the Interest Schemes Act 2016 are complied.

“Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to paragraph 214(6)(a) of the Financial Services Act 2013 and paragraph 225(6)(a) of the Islamic Financial Services Act 2013.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

| > Interest expense | 75% deductible |

| > Lease rental | 75% deductible |

| > General reinsurance premiums | 100% deductible |

| > Other type of payments | 3% deductible |