Guidelines on establishment of Labuan mutual funds including Islamic mutual funds was issued by Labuan Financial Services Authority (“Labuan FSA”) on 1 January 2014 (the “Guidelines”).

The mutual fund or fund sector in Labuan is allowed to be structured as a Labuan company, partnership, protected cell company (“PCC”), or unit trust. You may also set up Labuan Islamic mutual funds operating in compliance with Shariah principles.

DEFINITION

Mutual fund activities mean:

- collects and pools funds for the purpose of collective investment with the aim of spreading investment risk; and

- issues interests in a mutual fund which entitles the holder to redeem his investments that is agreed upon by the parties and received an amount computed by reference to the value of a proportionate interest in the whole or part of the net assets of the aforesaid types of entities, as the case may be,

and includes an umbrella fund whose interests in a mutual fund or units are split into a number of different class funds or sub-funds and whose participants are entitled to exchange rights in one part for rights in another.

LABUAN PRIVATE FUND

- MAXIMUM 50 INVESTORS

First time investment by each investor is NOT LESS than RM 250,000 (equivalent in Non-Ringgit);

OR

UNLIMITED NUMBER OF INVESTORS

First time investment by each investor is NOT LESS than RM 500,000 (equivalent in Non-Ringgit) - Not offered to general public

- Fund manager need not be licenced

- No approval required from Labuan FSA

- Notification to Labuan FSA prior to launching of fund by submission of fund offering documents

COMMON TYPES OF FUND VEHICLES

- COMPANIES

Ordinary shareholder & Preference shareholder(s) - LIMITED PARTNERSHIPS

General Partner & Limited Partner(s) - UNIT TRUSTS

Trustee & Unitholder(s)

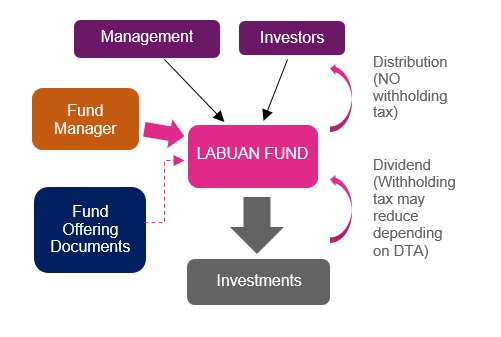

EXAMPLE OF MUTUAL FUND STRUCTURE

INFORMATION MEMORANDUM OF LABUAN PRIVATE FUND

Information memorandum of Labuan private fund should provide full, true and plain disclosure of all facts and circumstances that would facilitate a reasonable assessment by a prospective investor in determining whether to purchase or subscribe to the private fund and shall contain at least the following disclosures:-

- General Information

- Investment Strategy

- Financial Results

- Redemption Policy

- Material Changes

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on by a Labuan entity in, from or through Labuan.

Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act, 1967 (ITA).

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan

- excluding any activity which is an offence under any written law

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021:

- Labuan trading activity has been restricted to license business activities and other trading activities only. Please refer to the above Regulations 2021.

- Labuan non-trading activity has been categorised to 2 different types of holding activities, namely Pure Equity Holding and Non-Pure Equity Holding.

SUBSTANCE REQUIREMENT UNDER LBATA (with effect from 1st January 2019)

> Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall, for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

> Section 2B (1A) of LBATA provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

As the business activity of a Fund is generally involved in either Pure Equity Holding or Non Pure Equity Holding, the Substance Requirements are as follows:

Pure Equity Holding

To comply with management and control requirement in Labuan, the entity is to hold at least a minimum of one board meeting in Labuan for each calendar year and incur a minimum annual operating expenditure of RM20,000 per annum in Labuan.

Non Pure Equity Holding

To comply with minimum of one (1) full time employee in Labuan and a minimum annual operating expenditure of RM20,000 per annum in Labuan.

DEALINGS WITH RESIDENT MALAYSIA

Offerings of securities (including Labuan Private Fund) to residents directly and not via a Labuan Entity are subject to the provisions of the Capital Markets and Services Act 2007.

Hence, before any offering of securities is made to any residents, it is advisable to seek approval and recognition from the Securities Commissions of Malaysia.

KEY BENEFITS OF MUTUAL FUNDS IN LABUAN

- Flexible structure – in the form of Labuan company, partnership, protected cell company, foundation or unit trust.

- Support multiclass fund – multi currency / asset class.

- Hassle free private fund set-up – no approval required, fund manager need not be licensed.

- Simple tax structure.

- ZERO withholding tax on payments to non-residents.

- No foreign exchange controls.

- No capital gains tax / inheritance tax.

- Strategically situated in the Asia Pacific region and sharing a common time zone with many large Asian cities.

- Double Tax Agreements between Malaysia and over 70 countries.