The Labuan Limited Partnerships and Limited Liability Partnerships Act, 2010 (“LLPA”) provides the business and operations of Labuan Partnerships. The legislation provides a flexible partnership vehicle to entrepreneurs and businessmen with the benefit of limited liability.

All registration documentation must be submitted to the Labuan Financial Services Authority (“Labuan FSA”) through a registered trust company.

Kensington Trust Labuan Limited is a licensed trust company in Labuan and may assist you with establishment and administration of your Labuan Limited Partnership and Labuan Limited Liability Partnership.

COMMOM FORMS OF PARTNERSHIPS IN LABUAN

- Labuan Limited Partnership

- Labuan Limited Liability Partnership

Partnerships may be corporations except for those which are set up for professional practice, in which case it must consist of natural persons.

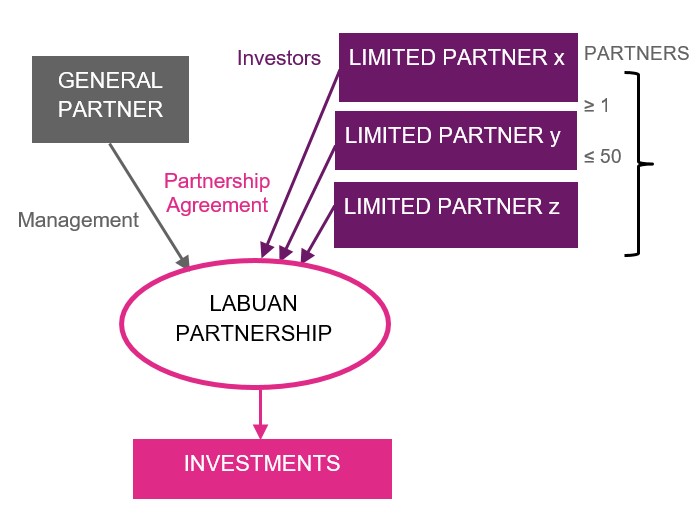

LABUAN LIMITED PARTNERSHIP (“Labuan LP”)

Notes:

- Labuan LP shall consist of at least two partners and not more than fifty partners of which one at least shall be a general partner and one at least shall be a limited partner.

- A general partner shall have all the rights and powers (i.e. management control) and shall be subjected to all the restrictions and liabilities of a partner.

- A limited partner shall contribute capital to the partnership but not participate in the daily operations of the partnership.

ADVANTAGES

- Excellent choice for individuals who lack the time or expertise to run a business but who would like to participate in the profits.

- Commonly used for joint venture. Liability for limited partners is merely capital which they invest in the business. Added benefit, they are also personally shielded from the partnership’s debts and other liabilities.

- Limited partners may leave or be replaced without the Limited Partnership being dissolved.

- Commonly used for private equity fund.

ANNUAL OBLIGATIONS

- Annual Government Fee: Pay annual fee on or before its anniversary date of registration.

- Annual Tax Filing: Annual tax return needs to be filed with the Malaysian Director General of Inland Revenue by 31 March of that year of assessment, or any extended for filing allowed by the Inland Revenue Board.

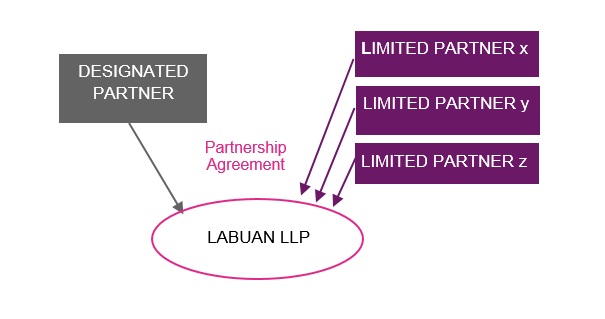

LABUAN LIMITED LIABILITY PARTNERSHIP (“Labuan LLP”)

Notes:

- Every partner of a Labuan LLP is the agent of the Labuan LLP and accordingly, the acts of a partner in the partner’s capacity as a partner shall bind the Labuan LLP.

- Liability of the partners are only limited to the agreed contribution in the Labuan LLP. Its liabilities shall be met out of the property of the Labuan LLP.

- The minimum number of partners for a Labuan LLP is two, i.e. one designated partner and one limited partner or two designated partner.

ADVANTAGES

- Commonly used for joint venture business. The liability of each interested party involved in the joint venture business is only limited to the amount of capital invested and terms in the partnership agreement.

- Suitable for professionals as it protects the partners from personal liability for claims arises from the other partners’ incompetency, error and omission.

- Limited liability of partners.

- Perpetual succession.

- Powers of a natural person.

- Any change in the partners of a Labuan LLP shall not affect the existence, rights or liabilities of the Labuan LLP.

ANNUAL OBLIGATIONS

- Annual Government Fee: Pay annual fee on or before its anniversary date of registration.

- Annual Solvency Certificate: File with Labuan FSA an annual solvency certificate on or before its anniversary date of registration.

- Annual Tax Filing: Annual tax return needs to be filed with the Malaysian Director General of Inland Revenue by 31 March of that year of assessment. Normally, an extension of time for filing is allowed by the Inland Revenue.

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan

- excluding any activity which is an offence under any written law

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021:

- Labuan trading activity has been restricted to license business activities and other trading activities only. Please refer to the above Regulations 2021.

- Labuan non-trading activity has been restricted to holding company, namely Pure Equity Holding and Non-Pure Equity Holding.

SUBSTANCE REQUIREMENT UNDER LBATA (with effect from 1st January 2019)

> Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall, for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

> Section 2B (1A) of LBATA provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

As Labuan LP is commonly used for private equity fund, this type of Labuan business activities will generally involve in either Pure Equity Holding or Non Pure Equity Holding. The Substance Requirements are as follows:

Pure Equity Holding

To comply with management and control requirement in Labuan, which includes holding of a minimum of one partners’ meeting in Labuan for each calendar year and incur minimum annual operating expenditure of RM20,000 in Labuan.

Non Pure Equity Holding

To comply with minimum of one (1) full time employee in Labuan and incur minimum annual operating expenditure of RM20,000 in Labuan.

Note:

As Labuan LLP is normally used for joint venture business or by professional services, these activities are not deemed as Labuan business activities and will thus be subjected to Malaysia’s Income Tax Act 1967 (instead of LBATA 1990).

DEALINGS WITH RESIDENT

All Labuan entities may conduct transactions with Residents of Malaysia in Ringgit Malaysia except for:

- Issuing or offering to any Residents of Malaysia for subscription or purchase; or

- Invite any resident to subscribe or purchase

any interest pursuant to the relevant provisions of the Interest Schemes Act 2016 where such issue or offer or invitation is made in Malaysia, other than Labuan, unless the provisions of the Interest Schemes Act 2016 are complied.

“Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to paragraph 214(6)(a) of the Financial Services Act 2013 and paragraph 225(6)(a) of the Islamic Financial Services Act 2013.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

| > Interest expense | 75% deductible |

| > Lease rental | 75% deductible |

| > General reinsurance premiums | 100% deductible |

| > Other type of payments | 3% deductible |