Revised guidelines for Labuan companies carrying out leasing business (including Islamic leasing business) in Labuan IBFC effective on 1 January 2019 was issued by the Labuan Financial Services Authority (“FSA”) on 5 March 2019. This Guidelines is not applicable for the underlying leasing transactions which are done for the purpose of facilitating the issuance of Sukuk Al-Ijarah. However, leasing structure structured by way of ijarah shall observe all the requirements of the Guidelines.

DEFINITION OF LEASING BUSINESS

It is the business of letting or sub-letting property on hire for the purpose of the use of such property by the hirer, regardless whether the letting is with or without an option to purchase the property. “Property” may include plant, machinery, aircrafts, ships (on bare-boat basis) or other chattel, moveable or immovable.

APPLICATION FOR LEASING LICENSE

Any person intending to undertake leasing business in Labuan IBFC may apply to Labuan FSA for approval.

Kensington Trust Labuan Limited is a licensed trust company in Labuan and is able to assist you with license applications, establishment and administration of your Labuan entities.

OPERATIONAL REQUIREMENTS

- Sufficient and positive capital or working funds which commensurate with the business operations at all times. Considerations shall include but not limited to the following factors:

- Volume of the business;

- Value of the asset leased; and

- Leasing arrangement i.e. operating or finance lease - Directors and officers must be fit and proper person.

- Adequate set of internal policies and controls for its operations, compliances, corporate governance and risk management.

- All leased assets are adequately insured.

- Maintain adequate and proper records and accounts.

- Appoint approved auditor in Labuan.

- Maintain bank account(s) preferably in Labuan IBFC and/or Malaysia to facilitate leasing operations.

- Related party leasing transactions are conducted at arm’s length basis and are subjected to transfer pricing rules and guidelines issued by relevant authorities.

- Comply with applicable laws, rules, regulations and guidelines relevant to leasing business issued by Labuan FSA and where applicable, regulatory requirements of the jurisdictions where the Labuan leasing business is authorised to operate in.

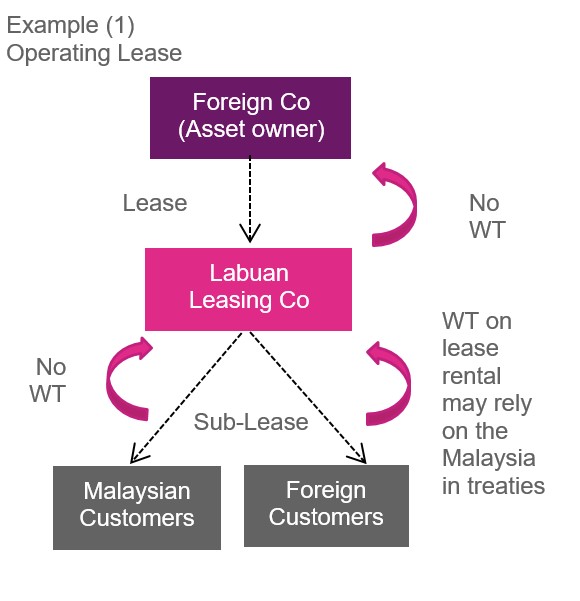

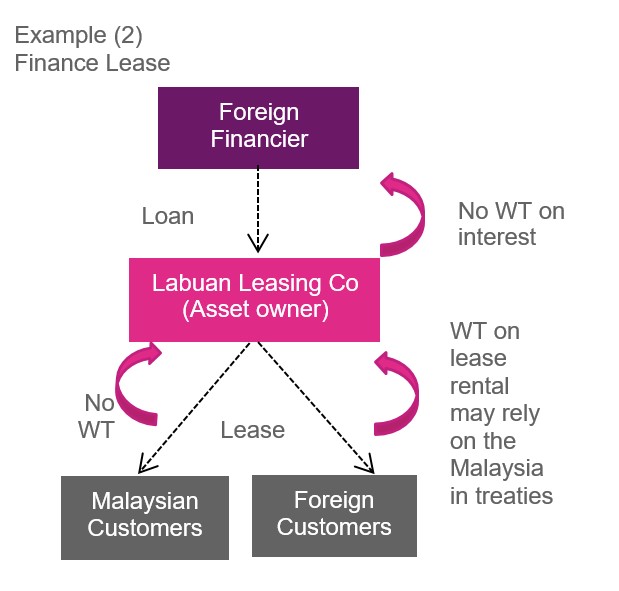

TYPICAL LABUAN LEASING STRUCURE

Notes to the above examples:

- With effect from 01st Jan 2019, Labuan Leasing Co is taxed at 3% of net audited profits.

- No withholding tax (“WT”) on lease rental received from Malaysian customers.

- With effect from 01st Jan 2019, lease rentals paid by Malaysian customers to Labuan Leasing Co are allowed 75% as deductions by the Malaysian customers.

- No withholding tax on lease rental payable by Labuan Leasing Co to Foreign Co. (example 1)

- No withholding tax on interest payments payable by Labuan Leasing Co to Foreign Financier (example 2)

- Access to benefits under Malaysia’s DTAs to reduce withholding tax on lease rental received by Labuan Leasing Co from Foreign customers.

- Liberal exchange control environment in Labuan.

PRIOR APPROVAL REQUIRED FROM LABUAN FSA

- Each new and subsequent leasing transactions including any change of lessee(s) and leased asset(s);

- Change of shareholders of more than 10%; and

- Appointment of directors

NOTIFICATION TO LABUAN FSA WITHIN 30 DAYS

- Change of place of business or office;

- Change of constituent documents and business plan including change of company’s name; and

- Termination/extension of any leasing transactions.

REPORTING TO LABUAN FSA

- Submit audited financial statements within six months from financial year end.

- Statistics, Compliance reporting and other information required by Labuan FSA.

LABUAN FSA LEASING FEES

Fees are payable to Labuan FSA to undertake Labuan leasing business dealing with Malaysian resident and non-Malaysia resident. Annual licence fee is payable latest by 15 January of each year.

Type of fees:

- Non-refundable processing fee of USD350 (once-off)

- Annual license fee of USD20,000

- Each subsequent approved lease transaction of USD6,000

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

Labuan entities that carry on a non-Labuan business activity are subject to the provisions of the Malaysian Income Tax Act, 1967 (ITA).

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan,

- excluding any activity which is an offence under any written law.

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021 that took effect on 1st January 2019:

- Labuan trading activity has been restricted to license business activities and selected type of trading activities only. Please refer to the above Regulations 2021.

- Labuan non-trading activity has been restricted to holding company, namely Pure Equity Holding and Non-Pure Equity Holding.

Section 2B (1A) of LBATA provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

With effect on 1 January 2019, Labuan leasing company (including Labuan Islamic leasing company) has to establish substantial activity requirements in Labuan. Substance requirements shall include but not limited to the following factors:-

> Physical presence: Maintain operational office in Labuan;

> Key leasing activities: Core income generating activities are to be carried out from the Labuan office;

> Annual business spending: Incur annual minimum operating expenditure in Labuan of RM100,000

> Employment

- Labuan leasing company which has not more than 10 related Labuan leasing companies : Minimum two (2) full-time employees for each group of companies;

- Labuan leasing company which has 11 to 20 related Labuan leasing companies : Minimum three (3) full-time employees for each group of companies;

- Labuan leasing company which has 21 to 30 related Labuan leasing companies : Minimum four (4) full-time employees for each group of companies;

- Labuan leasing company which has more than 30 related Labuan leasing companies: One (1) additional employee for each group of companies for each increase of 10 related Labuan leasing companies.

DEALINGS WITH RESIDENT

All Labuan entities may conduct transactions with Residents of Malaysia in Ringgit Malaysia except for:

- Issuing or offering to any Residents of Malaysia for subscription or purchase; or

- Invite any resident to subscribe or purchase

any interest pursuant to the relevant provisions of the Interest Schemes Act 2016 where such issue or offer or invitation is made in Malaysia, other than Labuan, unless the provisions of the Interest Schemes Act 2016 are complied.

“Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to paragraph 214(6)(a) of the Financial Services Act 2013 and paragraph 225(6)(a) of the Islamic Financial Services Act 2013.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

> Interest expense | 75% deductible |

> Lease rental | 75% deductible |

> General reinsurance premiums | 100% deductible |

> Other type of payments | 3% deductible |

ADVANTAGES & KEY BENEFITS OF LABUAN LEASING BUSINESS

- Labuan leasing company is taxed at 3% of net audited profits.

- ZERO withholding tax on payment of dividend, interest, lease rentals to non-residents.

- No foreign exchange controls.

- No import duty / sales tax.

- No capital gain tax / inheritance tax.

- Strategically situated in the Asia Pacific region and sharing a common time zone with many large Asian cities.

- Double Tax Agreements between Malaysia and over 70 countries.

- 100% exemption for director’s fees received by non-citizen directors of Labuan companies.