With the promulgation of the new legislation in 2010, Labuan is one of the few common law jurisdictions offering investors a choice of common law trusts and civil law foundations.

Traditionally used in civil law countries, a foundation is tailor-made for high net worth individuals, families as well as corporations and non-profit organisations who wish to have control over their assets and businesses whilst being accorded legal protection. All aspects of Labuan Foundations are governed by the Labuan Foundations Act 2010 (“LFA”). A Shariah compliant version is also available pursuant to the Labuan Islamic Financial Services and Securities Act 2010 (“LIFSSA”) whereby its aims and operations must be in compliance with Shariah principles. Guidelines on the Establishment of Labuan Foundation including Islamic Foundation were issued and revised by Labuan Financial Services Authority (“Labuan FSA”) on 4th April 2016 (“Guidelines”).

Foundation is a registered body corporate with a separate legal entity, usually established by the founder to hold assets with the objective of managing these assets for the benefit of a class of persons on a contractual basis. It is typically used for private wealth management, business succession, asset preservation, charitable purposes and other lawful activities.

The legislation in Labuan requires the engagement of services of a Labuan IBFC registered trust company to act as its establishment agent and secretary of the foundation in Labuan.

PURPOSE & OBJECT OF LABUAN FOUNDATION

Labuan foundation may be established to manage its own property for any lawful purpose which may be charitable or non-charitable.

Type

Non-Charitable Foundation

- For wealth management

Endowment of properties can only be done by founder and his assignee.

Charitable Foundation

- Private charitable

Not permitted to receive donations from third parties or the public.

- Public charitable

Endowment of properties can only be done by third parties and/or public

Charitable purpose means and includes any of the following description of purposes:

- The prevention and relief of poverty;

- The advancement of religion, profession or education;

- The advancement of health including the prevention and relief of sickness, disease or of human suffering;

- Social and community advancement including the care, support and protection of the aged, people with a disability, children and young people;

- The advancement of culture, arts and heritage;

- The advancement of amateur sport, which promote health by involving physical or mental exertion;

- The promotion of human rights, conflict resolution and reconciliation;

- The advancement of environmental protection and improvement;

- The advancement of animal welfare; or

- The advancement of facilities for recreation or other leisure-time occupation in the interest of social welfare.

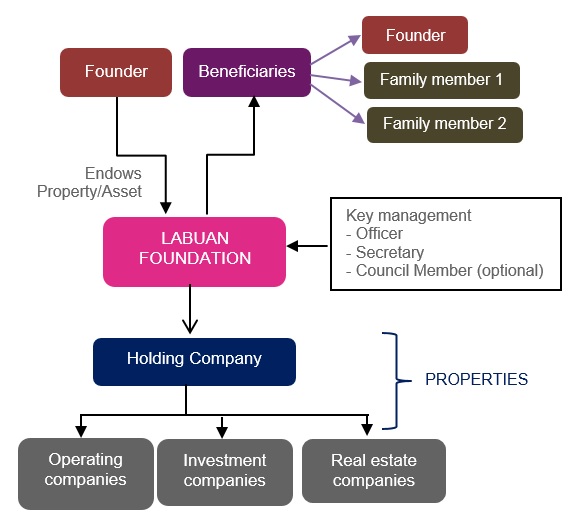

LABUAN FOUNDATION STRUCTURE

FOUNDATION COMPOSITION

FOUNDER |

|

BENEFICIARIES |

|

OFFICER |

|

COUNCIL MEMBER |

|

SECRETARY |

|

SUPERVISORY PERSON |

|

KEY FEATURES OF LABUAN FOUNDATION

- Name

Shall end with the words “Labuan Foundation” or “(L) Foundation”. - Registered Office

Mandatory to maintain a registered office in Labuan which shall be the address of the Secretary of the foundation. - Legal Status

It is a legal entity, it can enter into contracts, buy and sell properties, own bank accounts or own shares or interest in other corporations. - Duration

May be fixed or infinite life span. - Capital / Wealth Requirements

No capital requirements as a foundation does not have share capital. Minimum endowment of USD1.00 as an initial asset at time of establishment. - Assignment of Founder’s rights, powers and obligation

A founder may transfer its rights, powers and obligations if allowed by the charter of the foundation or any instrument in writing (e.g. deed of assignment) to be executed between the founder and his assignee. In this regard, the assignee who is assigned with such rights, powers and obligations shall be deemed to be a founder when exercising them or performing such obligations. The assignee also has the rights to endow his own assets into the Labuan foundation. - Property of Foundation

- Property of the Labuan foundation is owned legally and beneficially by the foundation and is to be utilised solely for the purposes and objects stated in the charter of the foundation.

- Property of the Labuan foundation can be Malaysian and/or non-Malaysian property.

- Any assets endowed to a Labuan foundation shall be the properties of such foundation.

- This includes:

(d.1) Assets of every kind whether corporeal or incorporeal, tangible or intangible, movable or immovable, however acquired may be endowed to a Labuan foundation; and

(d.2) Legal documents or instruments in any form, including electronic or digital, evidencing title to or interest in, such assets as described in the above bullet point including bank cheques, money orders, shares, securities, bonds, bank drafts and letters of credit. - The accounting records and other records shall be kept at the registered office of the Labuan foundation or at such other place in Labuan as the officers think fit and shall at all times be open to inspection by the council members, supervisory person, officers and the approved auditor, if appointed.

- A Labuan foundation shall ensure that its founder, council member, officer and secretary remain as fit and proper persons throughout their appointment with the foundation as may be prescribed in the Guidelines on Fit and Proper Person Requirements issued by Labuan FSA.

- A Labuan foundation shall ensure compliance with the Anti-Money Laundering and Anti-Terrorism Financing Act 2001.

- Dissolution of Labuan foundation may happen:

> upon the passing of a resolution by the officer on the basis that the foundation is established for a definite period and that period has expired;

> when the purpose of the foundation is fulfilled or becomes incapable of fulfilment; or

> when the charter requires such dissolution.

After the dissolution, the ownership of the remaining assets will be transferred to the beneficiaries.

- Property in Malaysia

- Labuan foundation for charitable purposes may hold Malaysian property and NEED NOT seek prior approval from Labuan FSA.

- For Labuan non-charitable foundations, including foundations established for the benefits of family members that intend to include Malaysian property MUST seek prior approval from Labuan FSA.

SPECIFIC REQUIREMENTS FOR LABUAN CHARITABLE FOUNDATION

Jurisdiction of operation | All Labuan charitable foundations are required to comply with the legal requirements of the jurisdiction or market they intend to operate in. |

Donations from public | A Labuan charitable foundation that solicits donation from the public shall comply with the following:

|

Representative Office | The Labuan charitable foundation is required to obtain prior approval of Labuan FSA before establishing a representative office outside of Labuan including Malaysia. The purpose is confined to carrying out facilitation of meetings and other administrative functions as approved by Labuan FSA. Income generating or fund raising activities including investments related activities, as well as maintenance of records and books of accounts of the foundation shall not be undertaken at the representative office. |

Private endowment and Public donation |

|

LABUAN ISLAMIC FOUNDATIONS

- A Labuan Islamic foundation may be established under the LIFSSA and all the provisions of the LFA shall apply to the Labuan Islamic foundation unless specifically provided. The object, purpose and activity of the Labuan Islamic foundation must be in compliance with Shariah principles.

- The officer of a Labuan Islamic foundation is required to appoint or consult a Shariah adviser to advise on matters relating to the operations of the Islamic foundation to ensure its compliance with Shariah principles.

- The endowment of property(ies) into the Labuan Islamic foundation can be done through hibah or hadiah.

- The Labuan Islamic foundation must have a clearly executed legal transfer of ownership of the property(ies) from the founder to the foundation.

LABUAN IBFC TAXATION SYSTEM

Labuan Business Activity Tax Act 1990 (“LBATA”) governs the imposition, assessment and collection of tax on a Labuan business activity carried on in, from or through Labuan.

“Labuan business activity” means:

- a Labuan trading or a Labuan non-trading activity carried on in, from or through Labuan

- excluding any activity which is an offence under any written law

Pursuant to the Labuan Business Activity Tax (Requirements for Labuan Business Activity) Regulations 2021 that took effect on 1st January 2019:

- Labuan trading activity has been restricted to license business activities and selected type of trading activities only. Please refer to the above Regulations 2021.

- Labuan non-trading activity has been restricted to holding company, namely Pure Equity Holding and Non-Pure Equity Holding.

“Entity” in LBATA includes Labuan Foundation established and registered under the Labuan Foundations Act 2010.

SUBSTANCE REQUIREMENT UNDER LBATA (with effect from 1st January 2019)

> Pursuant to section 2B(1) (b) of LBATA, the Labuan entities shall, for the purpose of the Labuan business activity, have :-

- an adequate number of full time employees in Labuan; and

- an adequate amount of annual operating expenditure in Labuan, as prescribed by the Minister by regulations made under this Act.

> Section 2B (1A) of LBATA further provides that a Labuan entity carrying on a Labuan business activity which fails to comply with the substance requirement for a basis period for a year of assessment shall be charged to tax at the rate of twenty four per cent (24%) upon its chargeable profits for that year of assessment.

As the business activities of this type of entity is generally involved in either Pure Equity Holding or Non Pure Equity Holding or Other Trading Activities, the Substance Requirements are as follows:

Pure Equity Holding

To comply with management and control requirement in Labuan, which includes holding of at least a minimum of one Council/Officer meeting in Labuan for each calendar year and incur minimum annual operating expenditure of RM20,000 per annum in Labuan.

Non Pure Equity Holding

To comply with minimum of one (1) full time employee in Labuan and minimum annual operating expenditure of RM20,000 per annum in Labuan.

- The business activities of a Labuan charitable foundation is not deemed as a Labuan business activity and will thus be subjected to the provision of Malaysia’s Income Tax Act 1967 (“ITA”).

DEALINGS WITH RESIDENT

All Labuan entities may conduct transactions with Residents of Malaysia in Ringgit Malaysia except for:

- Issuing or offering to any Residents of Malaysia for subscription or purchase; or

- Invite any resident to subscribe or purchase

any interest pursuant to the relevant provisions of the Interest Schemes Act 2016 where such issue or offer or invitation is made in Malaysia, other than Labuan, unless the provisions of the Interest Schemes Act 2016 are complied.

“Resident” here means:

- in relation to a natural person, a citizen or permanent resident of Malaysia; or

- in relation to any other person, a person who has established a place of business, and is operating in Malaysia.

- and includes person who is declared to be a resident pursuant to paragraph 214(6)(a) of the Financial Services Act 2013 and paragraph 225(6)(a) of the Islamic Financial Services Act 2013.

The amount of deductions allowed in respect of payments made by Residents to Labuan entities are as follows:-

| > Interest expense | 75% deductible |

| > Lease rental | 75% deductible |

| > General reinsurance premiums | 100% deductible |

| > Other type of payments | 3% deductible |

WHY FOUNDATION IN LABUAN?

- Build your LEGACY

- Registered corporate body with separate legal entity

- Can be for private or charity purposes

- Protection from creditors’ claims

- Protected from foreign claims and cannot be forcefully liquidated to satisfy other obligations such as claims arising from divorce, lawsuit or creditors

- Protection against forced heirship

- Not subject to compulsory perpetuity period

- Information concerning the Labuan foundation is not on any public record.

- Simple and straight forward tax systems in Labuan. No tax in Labuan on non-trading activities

- Founder can reserve powers and rights

- For distributions by a Labuan foundation to its beneficiaries, the beneficiaries will need to satisfy their own tax liabilities in their respective jurisdictions of tax residence. For beneficiaries in Malaysia, the distributions by the Labuan Foundation may be subject to tax under LBATA or ITA depending on where the foundation’s assets are located. Please seek official tax advice, if you need further elaboration.

- No foreign exchange controls

- No withholding tax /capital gain tax / inheritance tax