ESTATE PLANNING IS FOR EVERYONE

WHY?

EVERYONE HAS ASSETS

MAKING A PLAN IN ADVANCE

Gives you and your family peace of mind.

Makes it easier for your loved ones to handle your affairs during a time of grief.

Reduces possibility of family disputes.

Gives you control of who receives what and when.

Allows you to identify someone you trust to make decisions on your behalf if you become disabled.

Allows you to keep safe / preserve your wealth.

NO ONE CAN PREDICT WHAT WILL HAPPEN TOMORROW

Does anyone know where to find your records?

Have you provided proper instructions as to who gets what and when they are to receive it?

Who will take care of your elderly parents?

Who will look after the welfare of your young children?

Who will take over your business?

Will your hard earned wealth be passed to the rightful persons?

Are your children capable in handling sudden wealth?

WHY PEOPLE DO NOT PLAN?

I am not wealthy. I do not own enough.

I am not retired. I am not old enough.

I am busy.

Don’t know where to start.

Don’t know of anyone who can help me.

Don’t want to think about it.

It is not important.

HOW DO YOU START?

START BY WRITING YOUR WILL

A Will is a document that states your instructions and wishes. You need this if you wish:

To have your estate distributed according to your wishes after your death ie. your Gifts.

To specify who should receive your assets after your death ie. your Beneficiaries.

To name a person trusted by you to carry out your wishes ie. your Executor.

To name a person trusted by you to care for your minor children if both parents have passed away ie. a Guardian.

With a Will, your Executor will apply for a Grant of Probate from the Court to execute the contents in your Will including distributing your estate to named Beneficiaries.

Do you need more than a Will?

What happen if trigger event occurs?

EXAMPLES OF TRIGGER EVENTS

Physically disabled

Mental incapacity

Death

Who can legally take over on your behalf at the point of such trigger events to ensure continuing management of your financial assets?

Consider a STANDBY TRUST

or also known as a

successor or contingency trust

WHAT IS A STANDBY TRUST?

A Standby Trust is created during your lifetime. It is on standby / dormant mode and will become operational only when specified trigger events occur.

NOTES:

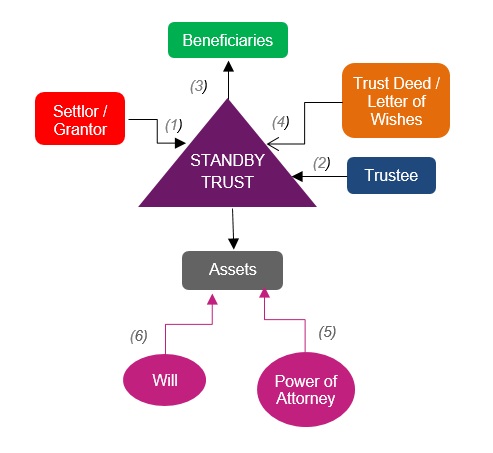

Client (“Settlor / Grantor”) sets up a Standby Trust.

Trustee is appointed at set-up but essentially on standby until occurrence of specified trigger events.

Beneficiaries will be named. The Client may also be named as beneficiary.

Terms of the Trust will be stated in the Trust Deed including defining trigger events of the Standby Trust.

Assets may be transferred to a Standby Trust via a Power of Attorney upon occurrence of trigger events.

If none of the trigger events happen during the lifetime of the Client, assets may still be transferred to the Trust upon death of the Client via a Will.

ADVANTAGES OF STANDBY TRUST

Revocable – you have the power to change the terms of the trust or revoke the trust during your lifetime.

Control – you keep control of your assets for as long as the trust is on standby / dormant mode. You decide when you want to activate your trust.

Flexible – you are not limited to the number of trigger events. The specific circumstances are entirely your choice.

Confidential – Unlike a Will, trust instruments are not made public.

Competent backup – upon occurrence of any trigger events, the trust will be activated. Your assets will be managed by the Trustee in the manner pre-determined by you with your Trustee.

Continuity – Your Standby Trust may continue after your death by providing in your Will that certain assets are transferred into your trust.

Peace of mind for you.

Easy set up and low cost when the trust is on standby / dormant mode.

WHO SHOULD BE YOUR TRUSTEE?

CHOOSING YOUR TRUSTEE

One of the most important decisions to make when setting up a trust is choosing the trustee. The trustee holds legal title to the trust assets. They owe a duty of care, good faith, honest and diligence towards the beneficiaries.

FACTORS FOR CONSIDERATION WHEN CHOOSING YOUR TRUSTEE

Corporate Trustee - guaranteed continuity of stewardship

Integrity

Decision-making ability

Competence

Knowledge & Experience of trust and relevant trust laws

Impartial and no conflict of interest

Availability

Ability to develop empathetic relationship with Beneficiaries

Trustee’s fees

Accountability